The day before, EvaluatePharma released 2017 global prospective report, 2017-2022 in pharmaceutical industry was prospected. According to forecasts, 2017-2022 years, the global prescription drug market will be 6.5% compound annual growth rate of expansion, by 2022 to reach $10600.

It is worth mentioning that this is the first time in the past ten years, EvaluatePharma lowered the sales forecast, in last years report, it predicts that in 2022 the global prescription drugs market will reach 11200 billion U. s.dollars.

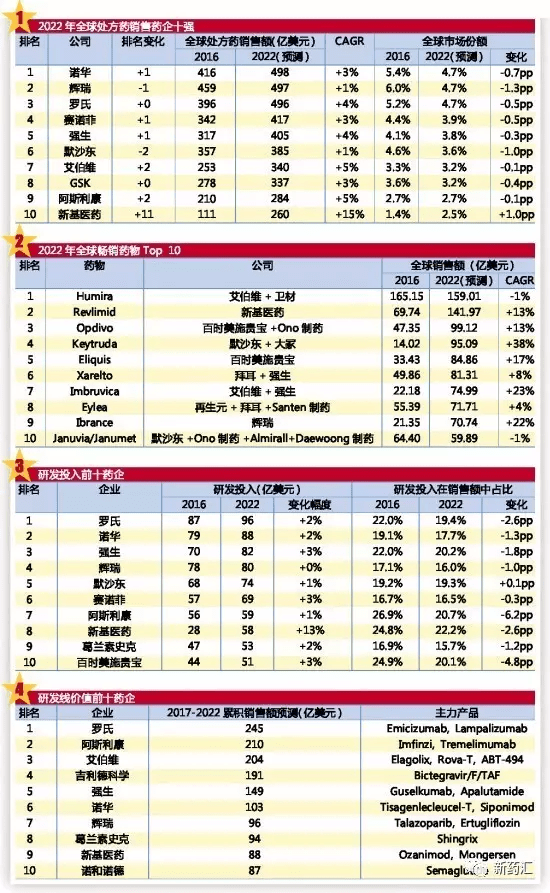

Best selling drugs

It is difficult to repair the throne of Miller

Over the next few years, the growth momentum in the prescription drug market will come mainly from cancer immune drugs, such as Opdivo and Keytruda, which, according to the report, will be three or four in the list of best-selling drugs by 2022.

In the title race, despite the Aibo Wei (AbbVie) repair Miller (Humira) has a number of manufacturers for the development of bio medicine is similar, but according to the forecast, the drug in 2022 will continue with $15 billion 900 million in sales to keep their best-selling drug status.

List of pharmaceutical companies

The top three are very close, and the ultimate winner is full of variables

However, Merck (Merck), Ai Bowei and Bristol Shi Guibao (Bristol-Myers Squibb) and not because of selling drugs have obtained a significant increase in the ranks of pharmaceutical companies. The report said that in 2022, Novartis (Novartis) will become the worlds largest prescription drug sales enterprise, and in last years report, this position by Roche. As before, the gap between the top three was slim, with Novartiss sales of prescription drugs at $49 billion 800 million by 2022, $49 billion 700 million for Pfizer and $49 billion 600 million for Roche, according to Pfizer.

But once the impact of a similar biological drug is stronger than expected, the list of pharmaceutical companies will change. Roche and Pfizer are faced with the threat of a larger biological drug competition.

Among them, because of its best-selling products and Roche Avastin Herceptin patent in the next two years will be the greatest pressure, but it has passed the Tecentriq and Ocrevus approved strengthen their product line, which will compensate for the loss of sales. For Pfizer, it is widely believed that the company needs a merger that will transform it, which may seek such acquisitions. At present, the ranking of several pharmaceutical companies may change at any time.

Growth potential

20 strong pharmaceutical companies, new base medicine, Shire fastest growing

In the global pharmaceutical companies Top 5 list, the new medicine base (Celgene) and Shires highlights, in the next few years will be respectively 15% and 10% compound annual growth rate of growth, is the fastest growing global pharmaceutical companies in the top 20 of the two companies. Shires acquisition of Baxalta brought growth momentum; at the same time, Revlimid, a new medicine based drug, continued to perform well, and new products, Otezla and Pomalyst, began to force themselves. Notably, new base medicine is still highly dependent on lenalidomide, which raises the companys risk levels.

Of course, new - base medicine is not the only one worried about its best selling products facing competition from generic drugs. The report predicts that sales of up to $194 billion over the next 5 years will be at risk of competition from generic drugs. One of the most important concerns is the decline in sales of those best-selling biological drugs.

R & D investment

New base and BI growth is highest, Roches handwriting is biggest

For analysts, Biogen and Johnson (J&J) R & D lines have the highest net present value (NPV). Among them, 100 healthy in phase III clinical anti amyloid protein in Alzheimers disease drug candidate aducanumab NPV of $10 billion; Johnson prostate cancer treatment with non steroidal antiandrogen apalutamide NPV is also close to $10 billion, according to the forecast, the drug in 2022 sales will reach $1 billion 600 million.

R & D investment in global pharmaceutical companies is expected to reach $157 billion 500 million this year, quite the same as last year, but by 2022, this figure is expected to increase to $181 billion. According to calculations, last year, the pharmaceutical industrys R & D investment accounted for 20.4% of prescription drug sales, the proportion is expected in 2022 will be reduced to 17.1%. The report notes that in 2007-2016 years, the pharmaceutical industry in the R & D work, the cumulative cost of up to 13600 billion U. s.dollars.

By analyzing the cost of R & D, EvaluatePharma estimates that a new molecular entity will cost as much as $4 billion over the last ten years.

According to the report, Roche will be ahead of other pharmaceutical companies with $9 billion 600 million in R & D in 2022. In the development of investment of the top 20 pharmaceutical companies, new medicine and Blyngju G John (Boehringer Ingelheim) R & D investment growth rate ranked the top two, from now until 2022, the year will be respectively 13% and 6% of the increase in R & D budget.

R & D value

Roche topped the list, AstraZeneca, Abe into the top three

Roche also topped the R & D charts. The report says the company is proving its ambition to act as a leader in the fight against cancer. Roches hemophilia potential "blockbuster" emicizumab (despite some clinical trial problems), and the treatment of map atrophy (the form of progression of dry AMD) is considered the most promising lampalizumab. The report predicts that the two drugs will generate a total of $24 billion 500 million in sales revenue by 2022.

Research value of the top three other companies AstraZeneca (AstraZeneca) and Ai Bowei (AbbVie), wherein, AstraZeneca to tumor immune drugs Imfinzi and tremelimumab approved its new anticancer drug candidate, Ai Bowei with the GnRH antagonist elagolix, anticancer drug candidate antibody drug conjugates Rova-T and JAK inhibitor ABT-494 on the Roche.

Return on investment (ROI), Novo Nordisk (Novo Nordisk) report that will lead the industry as a whole, the ROI reached 4.8, the new medicine base followed by ROI 2.7, Bayer (Bayer) ranked third.

The report pointed out that, in the pharmaceutical companies three strong, only Roches ROI is higher than 1, Pfizer and Novartis in the R & D field of large investment seems to encounter problems in cash. According to the report, the Bristol Myers Squibb and new pharmaceutical companies, the implementation of reinforcing the acquisition is expected to help further enhance ROI.