2017 in the first half of the year, many drugs left a deep impression on us. Both old and solid Humira is still nearly 20% growth in the 20 billion sprint history of drug sales myth, Keytruda also significantly accumulate steadily, narrow the gap with competitors, as well as Spinraza such a rookie, to open up the identity expensive orphan drug market, people marvel. This article selects 20 new drugs which have a better market performance in 2017H1 (FDA approved the listing time less than 3 years) to make a comment.

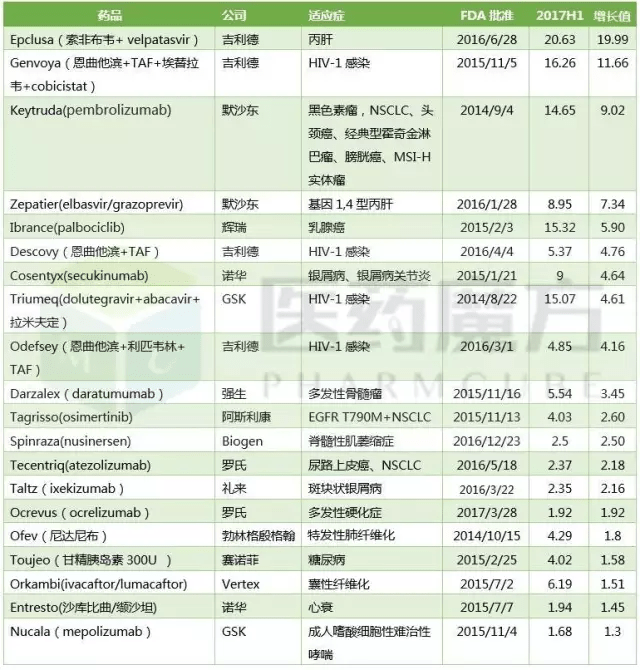

2017H1s best performing new drug TOP20 ($100 million)

Note: 1) the sales units of Tecentriq and Ocrevus are 100 million Swiss francs, and the Toujeo and Ofev sales units are 100 million euros. 2) Humira (adalimumab), Eliquis (Shaaban, Revlimid, droperidol) (lenalidomide), Imbruvica (ibrutinib), Tivicay (dolutegravir) and other drugs have a very good performance, but the market for more than 3 years, within the scope of this article is not visible: 15 foreign the main product sales data of 2017H1 pharmaceutical companies

1Epclusa (Sophie Bouvet + velpatasvir)

Epclusa (Sophie Bouvet + velpatasvir, NS5B+NS5A) is the worlds first oral hepatitis C drugs listed for all 6 genotypes of HCV infection and provide a cure rate of 12 weeks treatment more than 94% of the patients (see: big kill Gilead to: first all genotypes of hepatitis C drug Epclusa a group of FDA). Epclusa is approved by FDA in June 28, 2016, and staged 2 days sold $64 million in sales (see Myth: super! Hepatitis C drug Epclusa listed 2 days sold $64 million!).

Under fully competitive market environment in HCV Epclusa, although less than Sovaldi, Harvoni listed at the beginning so compelling, but the $1 billion 752 million sales performance will become a drug sales history of a story of the first half of 2016 time. 2017H1, Epclusa Gilead with $2 billion 63 million in sales during the first half of the year, Gilead become the most dependable products, can compensate for the shrinking Sovaldi, Harvoni market share (see: Gilead 2017H1 performance: total revenue of $136.5 billion over the expected $360 million deposit to mergers and acquisitions).

The hepatitis C market is already Cidaoxianhong the situation, Epclusa growth momentum is very difficult to have been so optimistic, especially AbbVie can also be applied to genotype 1~6 HCV infection of hepatitis C drug Maviret (G/P, NS3/4A+NS5A) in July 28th has just been approved by FDA, only 8 weeks the cure rate reached 97.5% (see: third global gene type hepatitis C drug market: 8 week cure rate as high as 97.5%), and the retail price to $26400 per course of treatment (8 weeks), $3600 cheaper than Harvoni, it is not to let people live rhythm. The advantage of Gilead is that the product line is more comprehensive, in addition to Epclusa, hepatitis C drug second applies to gene type 1~6 have been approved (see: cable failure will not be afraid of the treatment of non boue! FDA approved second gene of hepatitis C drug Vosevi), suitable for Sophie Bouvet resistant hepatitis C patients.

2Genvoya (emtricitabine +TAF+ elvitegravir +cobicistat)

Genvoya is approved by FDA in 2015/11/5, 2015/11/23 is approved by EMA, Gilead launched the first TAF based on the four one AIDS cocktails, then Gilead based on the development of TDF generation, Truvada, Viread AIDS drugs Atripla, Complera/Eviplera, Stribild step into the decline stage. 2017H1 sales of these 5 drugs were down to a different extent compared to the same period in 2016, while Genvoya increased by $1 billion 166 million compared with the same period, becoming the best performing products for the AIDS business segment.

3Keytruda(pembrolizumab)

Keytruda is currently the only PD-1/PD-L1 can be used as first-line treatment of NSCLC drugs, this market is the biggest cancer indications to help Keytruda to achieve explosive growth in 2017Q2, but also to Keytruda sales revenue in the first half compared to the same period in 2016 increased by 160%. Sales gap between Keytruda and Opdivo in the second quarter has narrowed to $314 million. Opdivo currently has 6 major tumor indications approved, if taking into account the Keytruda history as the first specific molecular markers and non-invasive tumor medicine, Keytruda indications are more than Opdivo, but PD-1/PD-L1 O-K on the market is not to dispute when the winner (see: PD-1 the latest market trend fast - cake bigger, O-K has significantly narrowed the gap).

4Zepatier(elbasvir+grazoprevir)

Zepatier time to market later than Sovaldi for more than 2 years, 1 years after Viekira, which makes the MSD earn billions, but the high price has received unprecedented attention in 2016, with nearly 40% cheaper than the Gilead Zepatier small fresh face hit the market, win the pay a lot of heart, 2016 get a score of $555 million. 2017H1, in the same period, Viekira Harvoni rival Sovaldi, fell across the board, the Zepatier has made a record of 895 million dollars, according to the rate of growth is very scary, but in fact is only Zepatier late victory, but also not worth celebrating what, after all, C liver market competition will be more intense. AbbVies new drug gene of hepatitis C $26400 / Maviret treatment (8 weeks), Zepatier in 2018 can maintain the current momentum is still very difficult to say.

5Ibrance(palbociclib)

Ibrance is the worlds first listed CDK4/6 inhibitor, FDA in February 3, 2015 accelerated approval, Novartis Kisqali in 2017/3/13 approved before the exclusive market, more than 2 years, sales rose fly up from $723 million in 2015 to $2 billion 135 million in 2016, to $1 billion 532 million for 2017H1, Ibrance performed a perfect three jump. However, Lillys similar products, abemaciclib, are expected to go public in 2018, and Ibrance growth will slow down.

6,7Descovy、Odefsey

Descovy (emtricitabine +TAF) and Odefsey (emtricitabine + Li horse Wei Lin +TAF) is Gilead at the beginning of 2016 approved two other aids cocktails based on TAF, 2017H1 brings the total revenue of $1 billion 22 million for the Gilead, ensure the Gilead HIV drug product line competition force, but also bring the medicine has better curative effect, higher safety for patients.

Although from the perspective of market competition, Gilead is facing the impact of GSK, before the ruling position as competition can help too strong to break, but innovation, we can also see Gilead under pressure from the GSK bictegravir to promote faster, this is a good thing for patients

8,9Cosentyx、Taltz

Cosentyx (secukinumab) is the worlds first listed IL-17A mAb, 2015/1/27 FDA approved, listed more than 2 years, the extension of indication to plaque psoriasis and psoriatic arthritis (PsA), ankylosing spondylitis (AS), has a total of 90 thousand patients about prescription. Secukinumab defeated Stelara in head to head study, sales revenue in second years listed on breaking the $1 billion mark (see: "head to head" on the beat Johnson Stelara, Novartis, Cosentyx will be the new leading psoriasis drugs?) Sales of $900 million in the first half of the year were impressive, too.

Taltz, the second listed IL-17A mAb in the world, had $235 million in sales in the first half of this year. With the expansion of the market share of autoimmune diseases, the future performance of Cosentyx and Taltz is worth looking forward to.

10Triumeq(dolutegravir/abacavir/拉米夫定)

If Geely relies on TAF, then dolutegravir (DTG) is GSKs revival in the AIDS drug market. After dolutegravir has launched Tivicay single drug and compound medicine Triumeq, GSK new AIDS drugs in the market recall feeling boss of the past, to challenge the Gilead (see: GlaxoSmithKline VS Gilead: the two generation of AIDS overlord deep battle). Triumeqs sales revenue is $1 billion 507 million at 2017H1 and will play a protracted battle with Cobolli Gigli in the future.

11Darzalex(daratumumab)

Darzalex (daratumumab) is the first monoclonal antibody drugs approved for the treatment of multiple myeloma, although initially as a four line of clinical medication, the crowd is narrow, but still impressive, made a $572 million mark in 2016. 2016/11/21, Darzalex indications expanded to combined with lenalidomide and dexamethasone, or in combination with bortezomib and dexamethasone as second-line drugs; 2017/6/16, Darzalex indications to expand joint pomalidomide and dexamethasone as three line therapy. Darzalex in the first half of this year to tie the performance of last years contribution of $554 million, the follow-up is expected to be better performance.

12Tagrisso(osimertinib)

Tagrisso built a new line of defense for EGFR resistant NSCLC patients, one of the largest in AstraZenecas current list of products. Tagrisso, a second line or three line drug, made $403 million in sales revenue at 2017H1. In July 27th, AstraZeneca announced positive results in the FLAURA study, 556 patients with locally advanced or metastatic NSCLC patients demonstrated Tagrisso as first-line therapy compared with erlotinib, gefitinib can result in clinically significant improvement of PFS. FLAURA research also provides support for Tagrissos forecast of $30+ billion sales peak.

Tagrisso was approved for sale in China in March this year (see: blockbuster)! AstraZeneca AZD9291 approved at home, a record of imported drugs on the market!) In view of the fact that China has become the most important market for AstraZeneca at present, the Chinese market with the largest number of lung cancer patients can provide new impetus for the growth of Tagrisso.

13Spinraza(nusinersen)

Spinraza, an antisense oligonucleotide, was approved in December 23, 2016 as the worlds first drug to treat spinal muscular atrophy (SAM). SMA is a rare fatal genetic disease that mainly affects muscle strength and movement. The patient is characterized by generalized muscular atrophy, weakness, progressive loss of motor function, and even breathing and swallowing. Age of onset, symptoms, and rate of progression are highly variable. SMA is the leading genetic disease killer among infants under 2 years of age, with a prevalence rate of 1:6000-1:10000 among newborns and about 3~5 million children in china.

Although the number of patients is relatively small, the Spinraza as an orphan drug has a pricing advantage, which costs $750 thousand in the first year and $375 thousand per year thereafter. Spinrazas sales revenue was $47 million in the first quarter of this year, but it was $203 million in the second quarter, which is expected to exceed $1 billion in the first year of Spinraza. The FDA was approved for approval by accelerated approval, with a review cycle of only 3 months. Spinraza. Whether the approval process, or market performance, reflects the huge clinical needs.

14Tecentriq(atezolizumab)

Tecentriq has now been granted two indications for bladder cancer and NSCLC.The current PD - 1 / PD - L1 market is the o - K war, one after another, Tecentriq earned 237 million Swiss francs in the first half of the year, showing Roches strength in the area of cancer.Looking back at the failure of the opdivo lung cancer trial, the failure of the keytruda head and neck cancer clinical study, and the failure of tecentriq to appear in one of the leading bladder cancers, the failure of imvigor211 research seems to be no big deal.

15Ocrevus(ocrelizumab)

Ocrevus (ocrelizumab) is a selective targeting of B cells from human CD20+ monoclonal antibody, is by far the most effective drugs for the treatment of MS, is the first time approved for treatment of relapsing remitting multiple sclerosis (RRMS, 85%) and primary progressive multiple sclerosis (PPMS, 15%) two kinds of drugs type MS. The starting dose was 600mg, 2 times, 1 times a week, followed by a dose of 600mg, 1 times every 6 months, 300mg.

It was impressive that Ocrevus received 192 million Swiss francs in just 3 months from the approval of March 28th. Ocrelizumab by Roche developed in collaboration with Biogen, according to the cooperation agreement, after the listing of ocrelizumab, Biogen can be obtained from a certain percentage of the sales revenue into Roche, which is divided into the proportion of the U.S. market for 13.5%~24%, the market outside the United States is 3%. The frequency of Ocrevus use is so low that quarterly changes in sales are a concern.

16Ofev (Neda Knibb)

16Ofev (Neda Knibb)

Ofev (Neda Knibb) is the first tyrosine kinase inhibitor approved by FDA for the treatment of idiopathic pulmonary fibrosis (IPF). Prior to this, IPF had no effective drug for fatal lung disease, and the median survival was only 2~3 years. In July 2015, Neda Knibb was included in the ATS/ERS/JRS/ALAT diagnosis and treatment of idiopathic pulmonary fibrosis international evidence-based guidelines recommend medication, when sales are rushing to 300 million euros in 2016 doubled Ofev sales reached 613 million euros, the first half of this year reached 429 million euros.

17Toujeo (glargine, 300U)

Toujeo (insulin glargine 300U) is Lantuss successor products, listed 2 years later, there is a better market absorption, 2017H1 contribution of 400 million euros, to a certain extent to compensate for the loss of Lantus patent expires.

18Orkambi(ivacaftor/lumacaftor)

After the withdrawal of the hepatitis C drug market, Vertex has been making a lot of money in the area of cystic fibrosis. Cystic fibrosis is an inherited disease mainly affects the exocrine glands, gastrointestinal and respiratory system, usually with chronic obstructive pulmonary disease, features of pancreatic exocrine insufficiency and elevated sweat electrolyte abnormalities, is a rare disease.

Vertex first introduced the first cystic fibrosis target drug, Kalydeco (ivacaftor), to treat CF patients with different CFTR mutations. After that, Orkambi (ivacaftor/lumacaftor) was introduced to carry double copy F508del mutant populations. These patients are the largest group of patients with cystic fibrosis, with about 30 thousand CF patients in the United States, about half of those with double copy F508del mutations, of whom about 8500 are 12 years of age or older. Given the Orkambi pricing of $259 thousand / year, its no surprise that you won $619 million in the first half of the year.

19Entresto(Shakubi Qu valsartan)

Heart failure drug Entresto has experienced 2 years of slump, sales began rising fast in the first half of 2017H1, nearly $200 million, an increase of nearly 300% compared to the same period in 2015, mainly due to the change of the pricing strategy of Novartis, and expand the sales team in the United States and europe. Entresto, which has just been approved by CFDA, is also helping to boost its global market share (see: blockbuster)! Novartis heart failure drug LCZ696 approved in china.

20Nucala(mepolizumab)

Nucala (mepolizumab) is the first approved global listed IL-5 monoclonal antibody by reducing serum eosinophil levels and reduce the onset of severe asthma, asthma and other approved drugs together for the maintenance treatment of severe asthma. Eosinophils are a type of white blood cell that contributes to the development of asthma. Nucala had $168 million in sales in the first half of this year, and could show better market potential later.